Unlock OVER 30%+ rETURNS WITH TEXAS LAND ENTITLEMENT

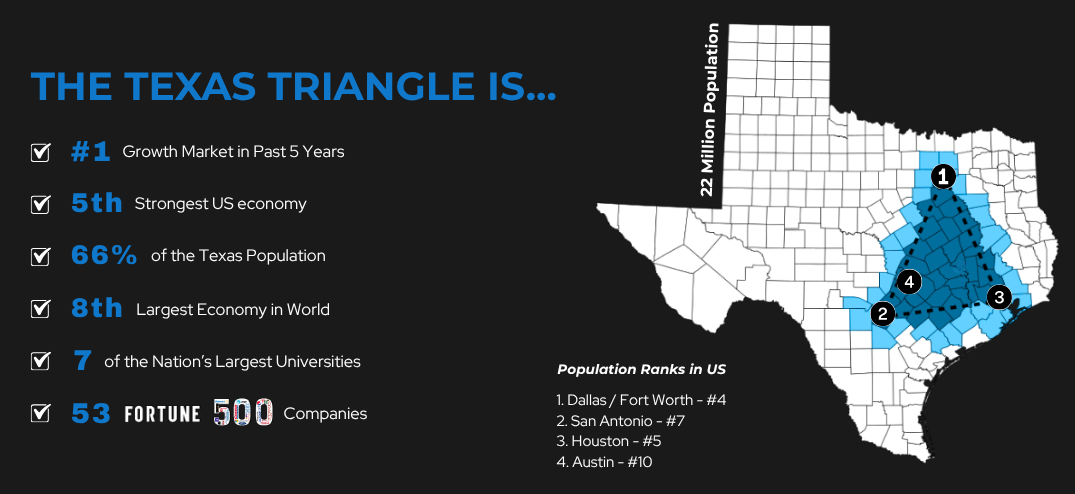

Join us in capitalizing on off-market land deals within the thriving Texas Triangle. Our focus on land entitlement projects offers investors the potential for substantial returns through strategic acquisitions and efficient exit strategies.

What is Land Entitlement?

In simple terms, land entitlement is the process of turning raw land into land that’s legally ready for development.

That means we work with the city to get the necessary approvals — like zoning, permits, and utilities — so the land can be sold to a homebuilder who’s ready to build.

By exiting before construction begins, we avoid the costs, delays, and risks that come with building — while still capturing the major increase in value that comes from getting the land entitled.

Why Investors Love This Opportunity

Built to Protect Capital. Structured to Scale.

Pre-Negotiated Land Exits

Five projects already have homebuilders lined up, reducing execution risk and pushing us past break-even early.

Cash Flow

Starts Month 3

Investors start receiving cash flow as early as Month 3, backed by GP fee participation and early buyer commitments.

No Risk from Construction

No build cost overruns, or weather risks—just clean exits with builder demand already in place.

Below

Market Fees

Our lean model keeps fees low—we only earn a success fee after you’ve received full capital back plus preferred return.

Investment Details

Highlights:

No Interest Rate Risk - Buying All Cash

Solving the Texas Housing Shortage

Builders Can't Hold Raw Land on Books

Builders Need Lots Right Now

Return Objectives

Preferred Return: 15%

Targeted Investor IRR: 28 - 34%

Targeted Investor Multiple: 2.40x - 2.60x

Investment Hold: 36 to 48 Months

Under Contract with Some of Texas’ Largest Homebuilders

Sponsor Track Record

$125M+

Track Record

27+

Projects Complete

3,500

Lots Sold

32.5%

Investor IRR*

Jackson Russell

Managing Partner

Real estate executive with 7+ years of residential acquisitions, construction and dispositions. Closed over $500M in deals with over $1B of financial due diligence.

Beth Augenstein

VP of Marketing

Marketing strategist with 12+ years of experience in real estate. Led over $950M in multifamily assets, specializing in lease-up and capital raise strategy.

Rylee Greenwood

Design & Social Media

Drives visual identity and manages social channels to engage investors and maintain consistent messaging across platforms.

Griffin Hullender

Investor Relations

Oversees investor communications, relationship management, onboarding, and ensuring transparency and alignment across all offerings.

How to Invest?

Ready to earn like a GP while investing passively? Here’s how to get started.

1. SCHEDULE

Set up a call with our Investor Relations team to review your goals and discuss investment opportunities.

2. Invest

Our team manages everything, making it a completely passive process for you with a tried-and-tested model.

3. stay Updated

Receive detailed project reports, updates, and exclusive insights to stay informed every step of the investment.

4. Build Wealth

Watch your investment grow with quarterly distributions as you move closer to achieving your financial goals.

© 2024 - 214 Capital. All rights reserved.

*Disclaimer: Past performance do not guarantee future results.